Are We In a Meltup?

Beware our Normalcy Bias

Laying Our Bed on Ice

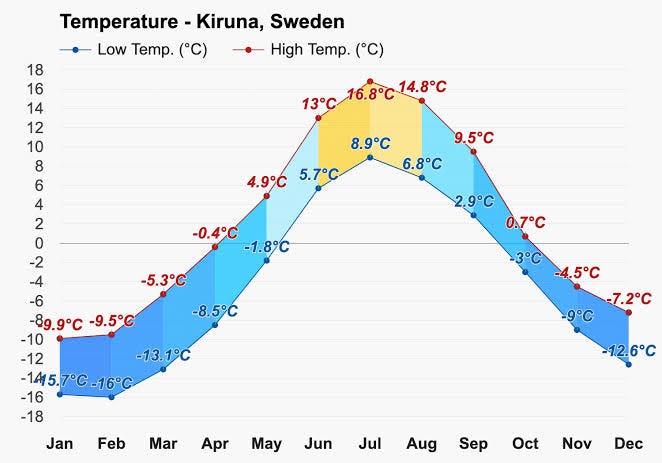

The Ice Hotel in Kiruna is a unique and temporary hotel that is rebuilt every year using ice and snow. It is located in the small town of Jukkasjärvi, near Kiruna, Sweden. The hotel offers an extraordinary experience where guests can sleep in rooms made entirely of ice, including ice sculptures, ice beds, and ice furniture. The hotel typically operates from December to April, as it requires cold temperatures to maintain its structure. Each year, artists from around the world contribute to designing and sculpting the hotel's interior, making each visit a truly memorable and artistic experience.

What happens in April though? Well, since ice melts at 0 degrees centigrade, and sleeping in a melting hotel might just be a little too much of a hard-sell for comfort loving tourists, the whole scene changes, and the humans evacuate.

What the guests are sidestepping is termed in science as a temperature phase shift. In this case, the phenomenon of water melting.

Phase Shifts

A temperature phase shift refers to the transition of a material from one physical state to another as the temperature changes. In the context of materials science, most commonly, phase shifts are observed in the states of matter: solid, liquid, and gas. When a material undergoes a temperature phase shift, its internal structure and properties can change significantly. For example, during melting, a solid transforms into a liquid, and during freezing, a liquid transforms into a solid.

One important temperature phase shift in materials is the glass transition temperature (Tg). Tg is the temperature at which an amorphous material, like glass or certain plastics, transitions from a rigid and glassy state to a more flexible and rubbery state. This transition occurs without any significant change in the material's chemical structure. Below the glass transition temperature, the material is in a glassy or brittle state, whereas above it, the material becomes more viscous and shows properties of a rubbery or polymer-like material.

Let us now imagine we were laying our tired heads down on a reindeer fur bed. Whether the temperature was -20ºC or -1ºC, the firmness (and moistness) of our bedding would not differ. A good night’s sleep would still be on the cards.

What would however cause a huge impact on our sleep would be if that temperature was to just rise another degree or two. We would then experience a phase shift.

At temperatures above the glass transition temperature (in this case, 0ºC), the material's molecular chains have enough thermal energy to move more freely, allowing for molecular mobility and increased flexibility. Resulting in plenty of free water molecules, and a puddle instead of a bed.

Could We Be In a Financial/Geopolitical Phase Shift?

I have chronicled in earlier posts the many moves taken by countries such as Russia and China, in their efforts to try and shake up the status quo. The reactions from nations on the fence since have been interesting. Some of the notable developments, in summary:

A trend of shifting away from international transactions and settlement in USD related assets1

Global acceleration of gold buying at the sovereign level

A willingness to take up arms against security threats emanating from the West

An awareness from commodity exporting nations that they might have leverage in their dealings with the west

A realisation that ex communication from the global SWIFT system might not always mean a financial apocalypse

An awareness that the global SWIFT system has been explicitly weaponised, therefore, one must invest their nations’ funds through a more nuanced lens.

What a list! We better prepare, and prepare soon! Right?

Maybe.

People (such as I) have been talking and threatening that change was on the horizon now for years. Why should one bear the costs of preparation now, seeing that the system never really changes?

To be fair, the system has gone through monumental shifts, and taken numerous blows, only to keep on keeping on.

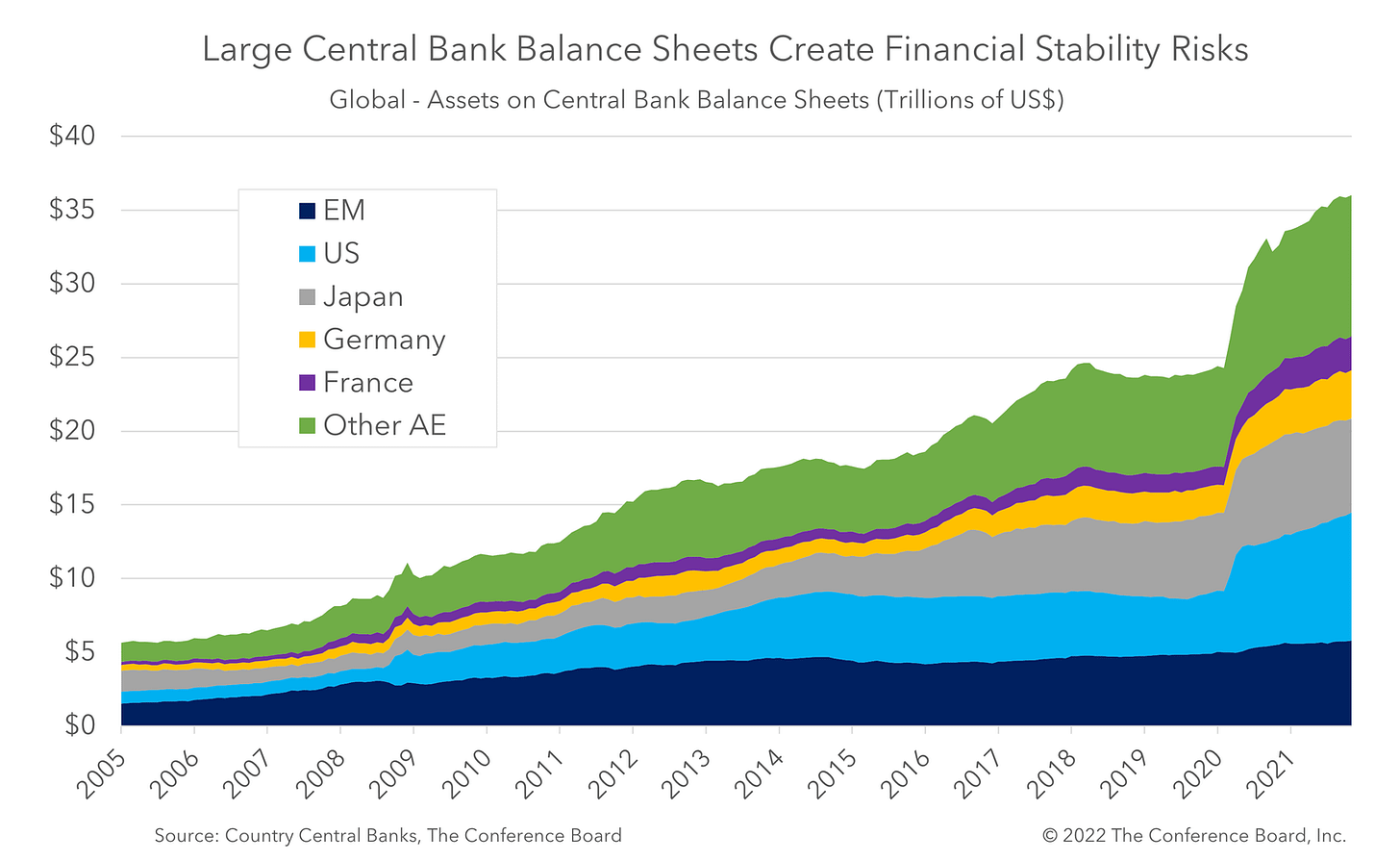

7x growth in central bank balance sheets since 2005? Who cares. 2

A financial system that was based on negative yielding debt?3 Talk about a mind bender. We are still here though.

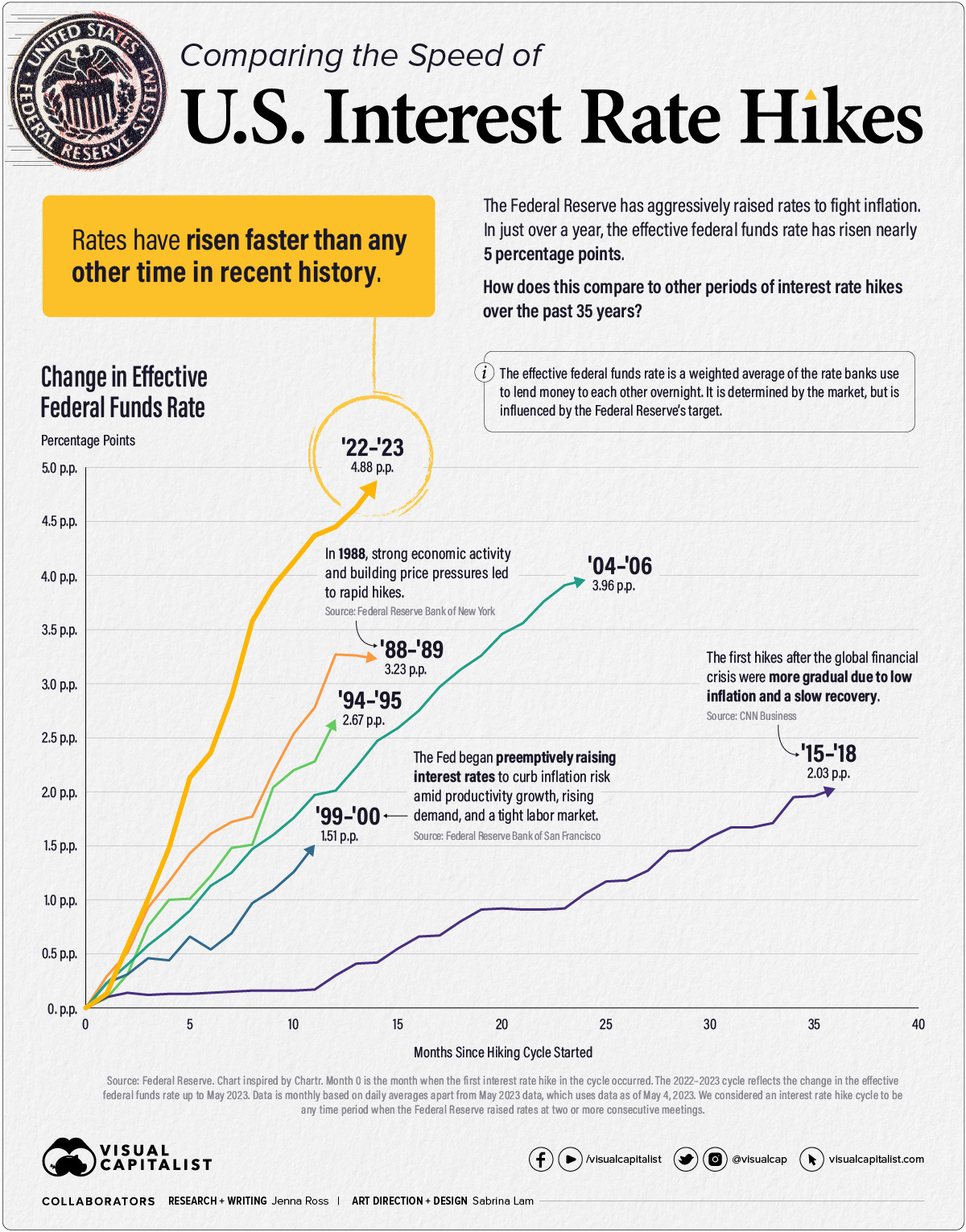

The fastest rates at which global interest rates have been raised? 4 HA! We are not even done yet!5

Banks failing? No worries. The central banks and her authorities are there to make sure no rugpulls are allowed for old money. 6 Right Oprah? *Wink Wink*. Just kidding, she managed to get out of a Harry situation and dodged that bullet.

Fundamental energy infrastructure to the largest bloc of nations getting attacked and destroyed, but no one mentions the event, so it must not matter.

A war between NATO and Russia being waged, where the world’s biggest exporter of commodities and finished products are not aligned with those that hold the keys to the financial system.

With all these happenings happening, the indices are still climbing higher, the dollar and the global banking system is still trusted and relied on, and life is still more or less carrying on as usual. We are definitely still in the Glass Phase of the movie.

The Fluid Phase

My question is, what if we were in glassy territory, but approaching the Tg temperature. How would we know? For most of us, our whole lives have been lived within the ice hotel’s December to April season. Bretton Woods came to be in 1944. We have been enjoying our icy solstice for so long, with the mesmerising views so beautiful, getting lulled into inaction is understandable. Who cares about the dawn when one has the aurora to stare into? “The dollar is King. Long live the king!”

What gets us into trouble

is not what we don’t know

It’s what we know for sure

that just ain’t so– Mark Twain

What happens in a world where Nigeria purchases shiny new Chinese automobiles in exchange for their precious crude oil products, without needing the services of anyone in London or New York? What if developing nations no longer needed to reserve western debt instruments for a rainy day? What if nations rallied around Iran, China and Russia, rather than isolated them as is expected? Are these events in the realm of possibility? If so, what must we do to be prepared?

I would argue that the points highlighted in this article and ones before are symptoms of a rising temperature, and might point to the fact that the structures we take for granted have started to liquify.

Let’s keep watching for the signs, and check in on our normalcy bias from time to time. It does not take long for one to go from snoozing on a reindeer fur, to staring at an angry bull ready to butt you off his patch.

Signing off from summery Europe.

At his press conference, Fed Chair Jerome Powell stressed that the central bank is seeking proof that inflation is “durably down” and noted that policymakers will take a “meeting by meeting” approach toward rates.